Frozen Food - Top Europe Industry Trends in 2026

EU frozen food demand is set for strong long-term expansion driven by convenience lifestyles, premium quality adoption, and advanced freezing technologies.

NEWARK, DE, UNITED STATES, November 14, 2025 /EINPresswire.com/ -- The demand for frozen food across the European Union is experiencing sustained acceleration, supported by rapidly evolving consumer lifestyles, expanding retail ecosystems, and widening acceptance of premium ready-to-cook and ready-eat categories. The market is on track to grow significantly through 2035, reflecting broader European shifts toward convenience, nutritional consistency, food waste reduction, and sustainable consumption patterns.

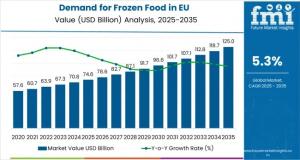

Between 2025 and 2035, frozen food consumption in the EU is projected to register a total market growth of 68.2%. This expansion is primarily driven by rising demand for long shelf-life food options, strong adoption of time-saving meal solutions, and wider penetration of modern cold chain infrastructure across EU member states.

Request Sample Report With Complete Market Breakdowns And Growth Estimates. https://www.futuremarketinsights.com/reports/sample/rep-gb-27184

Quick Market Snapshot

• Market value (2025): USD 74.6 billion

• Forecast value (2035): USD 125 billion

• CAGR (2025–2035): 5.3%

• Top freezing technology: IQF (42%)

• Key regional markets: Western & Central Europe

• Leading product segment: Frozen ready meals (35%)

Growth Timeline: 2025–2030 and 2030–2035

Between 2025 and 2030, the EU market is projected to expand by USD 22.3 billion, representing nearly 44% of decade-long growth. This phase is marked by rising urbanization, premiumization of frozen product categories, clean-label formulations, and the growing influence of modern retail chains in Eastern Europe.

From 2030 to 2035, the market will add USD 28.6 billion in new value. This period is expected to witness the widespread adoption of next-generation freezing technologies, sustainable packaging innovations, and rapid mainstreaming of organic and health-focused frozen meal solutions. Nutrition-backed frozen vegetables, premium seafood, and high-protein ready meals are increasingly gaining traction among EU consumers.

Why Frozen Food Demand Is Rising Across the EU

Modern European households are increasingly driven by time efficiency, nutrition consistency, and sustainable consumption habits. Frozen foods are emerging as preferred alternatives due to:

• Longer shelf life and minimal food waste

• High nutritional retention through advanced freezing systems

• Consistent portioning and meal planning support

• Growing acceptance among health-conscious and busy working households

Regulatory support is also strong. EU food authorities continue to implement stringent cold chain, labeling, and food safety requirements, boosting industry credibility and consumer confidence. European food science institutions are generating evidence reinforcing the nutritional reliability of frozen vegetables, fruits, proteins, and convenience meals—further strengthening mainstream adoption.

Segmental Insights

By Freezing Technique: IQF Dominates with 42% Market Share

IQF leads the EU market thanks to superior texture, quality retention, food safety compliance, and compatibility with large-scale industrial applications. The technique's operational efficiency and alignment with EFSA-mandated quality standards are enabling strong adoption among European processors.

By Product Type: Frozen Ready Meals at 35% Share

Frozen ready meals continue to outperform other categories, driven by rapid growth among dual-income households and rising demand for healthier, portion-controlled, gourmet, and ethnic meal options. Premiumization, clean-label formulations, and improved taste profiles are central to the segment’s expansion.

Country-Level Outlook

• Spain (CAGR 5.8%): Fastest-growing market due to modernizing food habits and strong retail expansion

• Italy (5.0%): Increasing integration of frozen foods into traditional cooking

• France (4.9%): Strong frozen meal culture supported by gourmet retail networks

• Germany (4.6%): High preference for premium, quality-certified frozen foods

• BENELUX (4.3%): Regional leadership in sustainability and premium frozen product adoption

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates - https://www.futuremarketinsights.com/checkout/27184

Competitive Landscape Intensifies

The EU frozen food sector is highly competitive, with global and regional players investing heavily in capacity expansion, advanced freezing technologies, premium product development, and sustainability-driven packaging. Leading companies include:

• Nestlé

• Unilever

• Conagra (Birds Eye EU operations)

• Nomad Foods (Findus, Iglo, Birds Eye EU)

• General Mills

• McCain Foods

• Dr. Oetker

• Picard Surgelés

• Frosta AG

• Iglo Group

These companies are strengthening their portfolios through acquisitions, clean-label innovation, cold chain optimization, and strategic retail partnerships across high-growth EU markets.

Browse Related Insights

Frozen Food Market: https://www.futuremarketinsights.com/reports/frozen-food-market

Frozen Food Market Share Analysis: https://www.futuremarketinsights.com/reports/frozen-food-market-share-analysis

Frozen Snacks Market: https://www.futuremarketinsights.com/reports/frozen-snacks-market

Why FMI: https://www.futuremarketinsights.com/why-fmi

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization trusted by Fortune 500 companies worldwide. With a global footprint across the U.S., UK, India, and Dubai, FMI delivers data-backed insights and strategic intelligence across 30+ industries and 1200 markets.

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.